“Buying a house is a stressful thing.”

Contrary to the widespread belief that house prices are dependent on the generic factors like number of bedrooms and square area of house, Ames Housing dataset proves that many other factors influence the final price of homes. This dataset contains 79 explanatory variables to describe almost every aspect of the house. Generally house buyers neglect this information. As a result their price estimation is very different from the actual prices.

Below is my first Data Science Project as part of Data Mining Course, a model to predict the prices of residential homes in Ames, Iowa, using advanced regression techniques. This will provide buyers will a rough estimate of what the houses are actually worth. This in turn will help them have better negotiation deals with sellers.

Most of the houses are bought through real estate agents. People rarely buy directly from the seller, since there are a lot of legal terminology involved and people are unaware of them. Hence real estate agents are trusted with the communication between buyers and sellers as well as laying down a legal contract for the transfer. This just creates a middle man and increases the cost of houses. Therefore the houses are overpriced and a buyer should have a better idea of the actual value of these houses.[2] There are various tools, like Zillow and Trulia, available online to assist a person with buying houses. These tools provide a price estimation of various houses and are generally free for use. These tools incorporate many factors to estimate the house prices by providing weights to each factor. For example, Zillow creates Zestimate of houses which is “calculated three times a week based on millions of public and user-submitted data points” [3]. The median error rate for these estimates are quite low. The main problem with these tools is that they are heavy on advertisements and they promote real estate agents. Zillow provides paid premium services for real estate agents and this is their main source of income.[4]

Estimates of actual house prices will help buyers to have better negotiations with the real estate agents, as the list price of the house and much higher than the actual price. Our prediction model will provide the buyers with these estimates.

We used the ‘Ames Housing dataset’ provided by [kaggle](https://www.kaggle.com/) for competition [House Prices: Advanced Regression Techniques](https://www.kaggle.com/c/house-prices-advanced-regression-techniques).

Python Packages

import warnings

import numpy as np

import pandas as pd

%matplotlib inline

%config InlineBackend.figure_format = 'png' #retina

import matplotlib.pyplot as plt

import seaborn as sns

import warnings

warnings.filterwarnings('ignore')

import scipy.stats as stats

from scipy.stats import skew,norm

from scipy.stats.stats import pearsonr

Data Preprocessing

train = pd.read_csv("./train.csv")

test = pd.read_csv("./test.csv")

#Save the 'Id' column

train_ID = train['Id']

test_ID = test['Id']

#Now drop the 'Id' colum since it's unnecessary for the prediction process.

train.drop("Id", axis = 1, inplace = True)

test.drop("Id", axis = 1, inplace = True)

We performed following statisitical analysis of the data for finding trends in data.

DataFrame Properties

print('Train Data: \n')

print("Number of columns: "+ str(train.shape[1]))

print("Number of rows: "+ str(train.shape[0]))

print('\nTest Data: \n')

print("Number of columns: "+ str(test.shape[1]))

print("Number of rows: "+ str(test.shape[0]))

Train Data:

Number of columns: 80

Number of rows: 1460

Test Data:

Number of columns: 79

Number of rows: 1459

Statistical data summary

train['SalePrice'].describe()

count 1460.000000

mean 180921.195890

std 79442.502883

min 34900.000000

25% 129975.000000

50% 163000.000000

75% 214000.000000

max 755000.000000

Name: SalePrice, dtype: float64

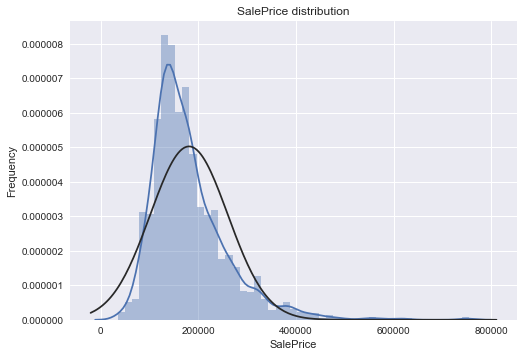

# Kernel Density Plot

sns.distplot(train.SalePrice,fit=norm);

plt.ylabel('Frequency')

plt.title('SalePrice distribution');

# Get the fitted parameters used by the function

(mu, sigma) = norm.fit(train['SalePrice']);

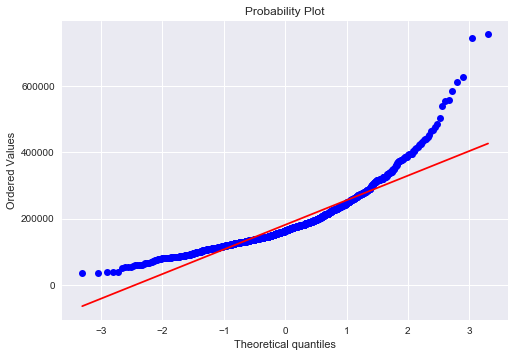

# QQ-plot

fig = plt.figure()

res = stats.probplot(train['SalePrice'], plot=plt)

plt.show()

](http://rahulraghatate.github.io/img/Property-Evaluation/output_6_0.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_6_0.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_6_1.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_6_1.png)

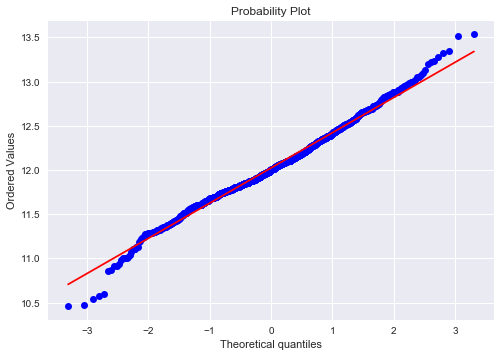

The target variable is right skewed(positive skewness) and show peakedness. As (linear) models fits better on normally distributed data , we require proper transformation.

Transform the skewed numeric features by taking log(feature + 1) - to make features more normal

Relation Exploration for Few Numerical Variables

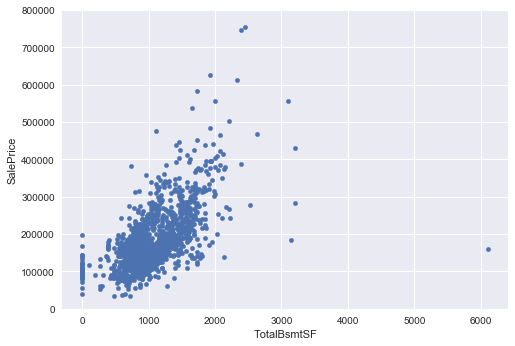

#scatter plot totalbsmtsf/saleprice

var = 'TotalBsmtSF'

data = pd.concat([train['SalePrice'], train[var]], axis=1)

data.plot.scatter(x=var, y='SalePrice', ylim=(0,800000));

](http://rahulraghatate.github.io/img/Property-Evaluation/output_9_0.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_9_0.png)

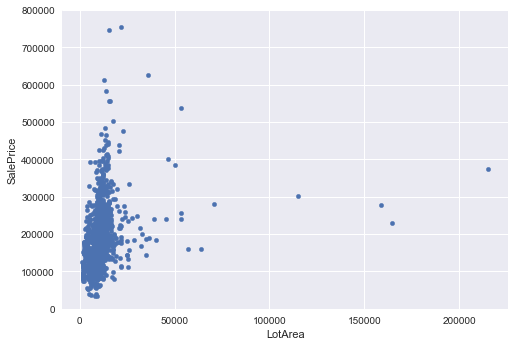

#scatter plot LotArea/saleprice

var = 'LotArea'

data = pd.concat([train['SalePrice'], train[var]], axis=1)

data.plot.scatter(x=var, y='SalePrice', ylim=(0,800000));

](http://rahulraghatate.github.io/img/Property-Evaluation/output_10_0.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_10_0.png)

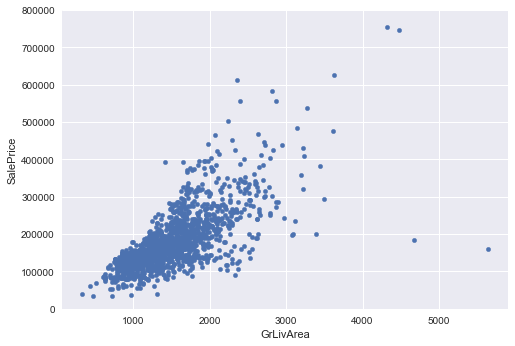

#scatter plot grlivarea/saleprice

var = 'GrLivArea'

data = pd.concat([train['SalePrice'], train[var]], axis=1)

data.plot.scatter(x=var, y='SalePrice', ylim=(0,800000));

](http://rahulraghatate.github.io/img/Property-Evaluation/output_11_0.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_11_0.png)

Deleting outliers

train = train.drop(train[(train['GrLivArea']>4000) & (train['SalePrice']<300000)].index)

‘TotalBsmtSF’,’LotArea’ and ‘GrLivArea’ seem to be linearly related with ‘SalePrice’. Both relationships are positive, which means that as one variable increases, the other also increases. In the case of ‘TotalBsmtSF’ and ‘LotArea’ we can see that the slope of the linear relationship are particularly high.

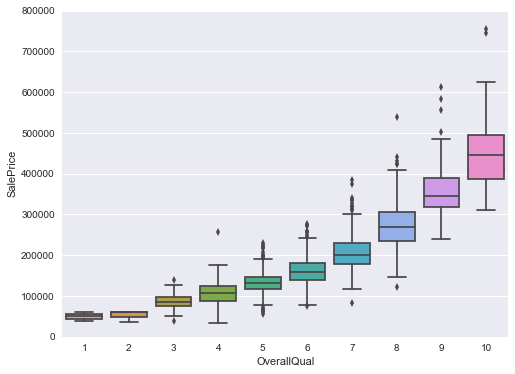

Relation Exploration for categorical features

#box plot overallqual/saleprice

var = 'OverallQual'

data = pd.concat([train['SalePrice'], train[var]], axis=1)

f, ax = plt.subplots(figsize=(8, 6))

fig = sns.boxplot(x=var, y="SalePrice", data=data)

fig.axis(ymin=0, ymax=800000);

](http://rahulraghatate.github.io/img/Property-Evaluation/output_15_0.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_15_0.png)

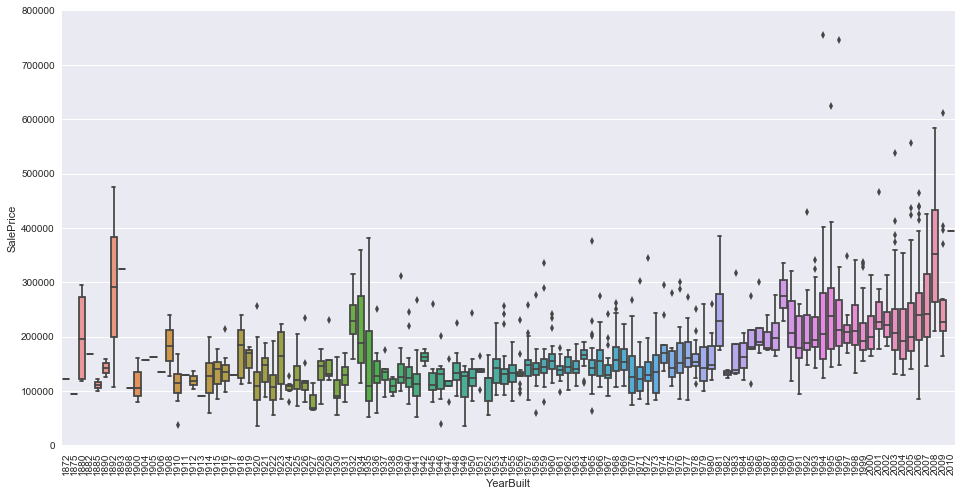

var = 'YearBuilt'

data = pd.concat([train['SalePrice'], train[var]], axis=1)

f, ax = plt.subplots(figsize=(16, 8))

fig = sns.boxplot(x=var, y="SalePrice", data=data)

fig.axis(ymin=0, ymax=800000);

plt.xticks(rotation=90);

](http://rahulraghatate.github.io/img/Property-Evaluation/output_16_0.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_16_0.png)

Note: we don’t know if ‘SalePrice’ is in constant prices. Constant prices try to remove the effect of inflation. If ‘SalePrice’ is not in constant prices, it should be, so than prices are comparable over the years.

OverallQual’ and ‘YearBuilt’ also seem to be related with ‘SalePrice’. The relationship seems to be stronger in the case of ‘OverallQual’, where the box plot shows how sales prices increase with the overall quality.

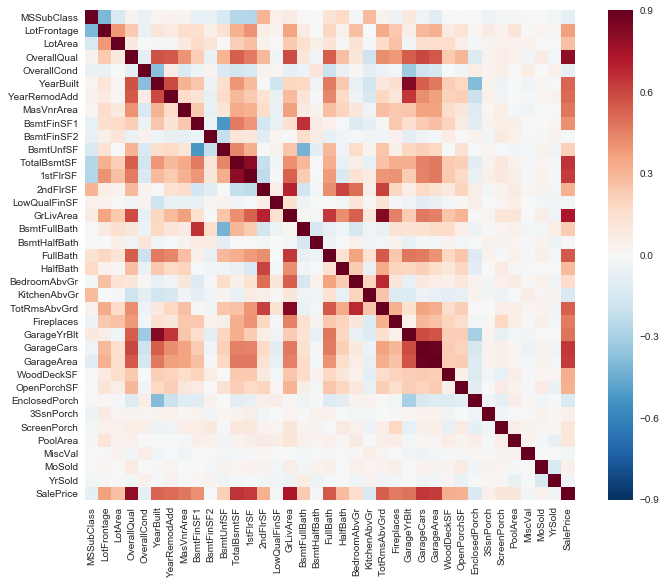

correlation matrix for all features

corrmat = train.corr()

f, ax = plt.subplots(figsize=(12, 9))

sns.heatmap(corrmat, vmax=.9, square=True);

](http://rahulraghatate.github.io/img/Property-Evaluation/output_19_0.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_19_0.png)

#skewness and kurtosis

print("Skewness: %f" % train['SalePrice'].skew())

print("Kurtosis: %f" % train['SalePrice'].kurt())

Skewness: 1.881296

Kurtosis: 6.523067

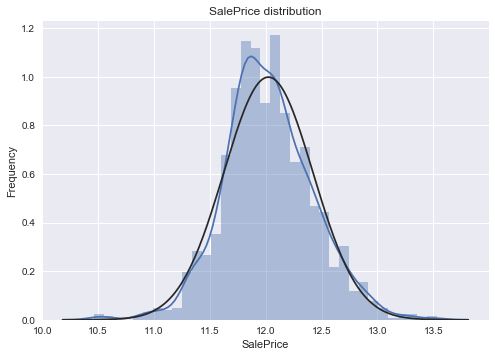

log transforming the target and Kernel Density plot for Sale Price values

train["SalePrice"] = np.log1p(train["SalePrice"])

# Kernel Density Plot

sns.distplot(train.SalePrice,fit=norm);

plt.ylabel('Frequency')

plt.title('SalePrice distribution');

# Get the fitted parameters used by the function

(mu, sigma) = norm.fit(train['SalePrice']);

# QQ-plot

fig = plt.figure()

res = stats.probplot(train['SalePrice'], plot=plt)

plt.show()

](http://rahulraghatate.github.io/img/Property-Evaluation/output_21_0.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_21_0.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_21_1.png)

](http://rahulraghatate.github.io/img/Property-Evaluation/output_21_1.png)

_Sample training dataframe__

train.head()

| MSSubClass | MSZoning | LotFrontage | LotArea | Street | Alley | LotShape | LandContour | Utilities | LotConfig | ... | PoolArea | PoolQC | Fence | MiscFeature | MiscVal | MoSold | YrSold | SaleType | SaleCondition | SalePrice | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 60 | RL | 65.0 | 8450 | Pave | NaN | Reg | Lvl | AllPub | Inside | ... | 0 | NaN | NaN | NaN | 0 | 2 | 2008 | WD | Normal | 12.247699 |

| 1 | 20 | RL | 80.0 | 9600 | Pave | NaN | Reg | Lvl | AllPub | FR2 | ... | 0 | NaN | NaN | NaN | 0 | 5 | 2007 | WD | Normal | 12.109016 |

| 2 | 60 | RL | 68.0 | 11250 | Pave | NaN | IR1 | Lvl | AllPub | Inside | ... | 0 | NaN | NaN | NaN | 0 | 9 | 2008 | WD | Normal | 12.317171 |

| 3 | 70 | RL | 60.0 | 9550 | Pave | NaN | IR1 | Lvl | AllPub | Corner | ... | 0 | NaN | NaN | NaN | 0 | 2 | 2006 | WD | Abnorml | 11.849405 |

| 4 | 60 | RL | 84.0 | 14260 | Pave | NaN | IR1 | Lvl | AllPub | FR2 | ... | 0 | NaN | NaN | NaN | 0 | 12 | 2008 | WD | Normal | 12.429220 |

5 rows × 80 columns

Exploring Missing value ratio

all_data = pd.concat((train.loc[:,'MSSubClass':'SaleCondition'],

test.loc[:,'MSSubClass':'SaleCondition']))

print("all_data size is : {}".format(all_data.shape))

all_data_na = (all_data.isnull().sum() / len(all_data)) * 100

all_data_na = all_data_na.drop(all_data_na[all_data_na == 0].index).sort_values(ascending=False)[:30]

missing_data = pd.DataFrame({'Missing Ratio' :all_data_na})

missing_data.head(20)

all_data size is : (2917, 79)

| Missing Ratio | |

|---|---|

| PoolQC | 99.691464 |

| MiscFeature | 96.400411 |

| Alley | 93.212204 |

| Fence | 80.425094 |

| FireplaceQu | 48.680151 |

| LotFrontage | 16.660953 |

| GarageFinish | 5.450806 |

| GarageYrBlt | 5.450806 |

| GarageQual | 5.450806 |

| GarageCond | 5.450806 |

| GarageType | 5.382242 |

| BsmtExposure | 2.811107 |

| BsmtCond | 2.811107 |

| BsmtQual | 2.776826 |

| BsmtFinType2 | 2.742544 |

| BsmtFinType1 | 2.708262 |

| MasVnrType | 0.822763 |

| MasVnrArea | 0.788481 |

| MSZoning | 0.137127 |

| BsmtFullBath | 0.068564 |

Imputing missing values

Based on feature description provided, following features if has NA means it’s absent(“None”).

for col in ('PoolQC','MiscFeature','GarageType','Alley','Fence','FireplaceQu','GarageFinish', 'GarageQual', 'GarageCond','MasVnrType','MSSubClass'):

all_data[col] = all_data[col].fillna('None')

# Replacing missing data with 0 (Since No garage = no cars in such garage).

for col in ('GarageYrBlt', 'GarageArea', 'GarageCars'):

all_data[col] = all_data[col].fillna(0)

# missing values are likely zero for having no basement

for col in ('BsmtFinSF1', 'BsmtFinSF2', 'BsmtUnfSF','TotalBsmtSF', 'BsmtFullBath', 'BsmtHalfBath'):

all_data[col] = all_data[col].fillna(0)

#

all_data["MasVnrArea"] = all_data["MasVnrArea"].fillna(0)

# For below categorical basement-related features, NaN means that there is no basement.

for col in ('BsmtQual', 'BsmtCond', 'BsmtExposure', 'BsmtFinType1', 'BsmtFinType2'):

all_data[col] = all_data[col].fillna('None')

# Group by neighborhood and fill in missing value by the median LotFrontage of all the neighborhood

all_data["LotFrontage"] = all_data.groupby("Neighborhood")["LotFrontage"].transform(

lambda x: x.fillna(x.median()))

# Setting mode value for missing entries

# MSZoning classification : 'RL' is common

all_data['MSZoning'] = all_data['MSZoning'].fillna(all_data['MSZoning'].mode()[0])

# Functional : NA = typical

all_data["Functional"] = all_data["Functional"].fillna("Typ")

# Electrical

all_data['Electrical'] = all_data['Electrical'].fillna(all_data['Electrical'].mode()[0])

# KitchenQual

all_data['KitchenQual'] = all_data['KitchenQual'].fillna(all_data['KitchenQual'].mode()[0])

# Exterior1st and Exterior2nd

all_data['Exterior1st'] = all_data['Exterior1st'].fillna(all_data['Exterior1st'].mode()[0])

all_data['Exterior2nd'] = all_data['Exterior2nd'].fillna(all_data['Exterior2nd'].mode()[0])

#SaleType

all_data['SaleType'] = all_data['SaleType'].fillna(all_data['SaleType'].mode()[0])

# Dropping as same value 'AllPub' for all records except 2 NA and 1 'NoSeWa'

all_data = all_data.drop(['Utilities'], axis=1)

# Transformation required for numerical features to categorical

all_data['MSSubClass'] = all_data['MSSubClass'].apply(str)

all_data['OverallCond'] = all_data['OverallCond'].astype(str)

all_data['YrSold'] = all_data['YrSold'].astype(str)

all_data['MoSold'] = all_data['MoSold'].astype(str)

Label Encoding some categorical variables for information in their ordering set

from sklearn.preprocessing import LabelEncoder

cols = ('FireplaceQu', 'BsmtQual', 'BsmtCond', 'GarageQual', 'GarageCond',

'ExterQual', 'ExterCond','HeatingQC', 'PoolQC', 'KitchenQual', 'BsmtFinType1',

'BsmtFinType2', 'Functional', 'Fence', 'BsmtExposure', 'GarageFinish', 'LandSlope',

'LotShape', 'PavedDrive', 'Street', 'Alley', 'CentralAir', 'MSSubClass', 'OverallCond',

'YrSold', 'MoSold')

# process columns, apply LabelEncoder to categorical features

for c in cols:

lbl = LabelEncoder()

lbl.fit(list(all_data[c].values))

all_data[c] = lbl.transform(list(all_data[c].values))

# shape

print('Shape all_data: {}'.format(all_data.shape))

Shape all_data: (2917, 78)

# Adding Total surface area as 'TotalSF'= basement+firstflr+secondflr

all_data['TotalSF'] = all_data['TotalBsmtSF'] + all_data['1stFlrSF'] + all_data['2ndFlrSF']

log transform skewed numeric features

numeric_feats = all_data.dtypes[all_data.dtypes != "object"].index

skewed_feats = all_data[numeric_feats].apply(lambda x: skew(x.dropna())).sort_values(ascending=False) #compute skewness

print("\nSkew in numerical features: \n")

skewness = pd.DataFrame({'Skew' :skewed_feats})

skewness.head(5)

Skew in numerical features:

| Skew | |

|---|---|

| MiscVal | 21.939672 |

| PoolArea | 17.688664 |

| LotArea | 13.109495 |

| LowQualFinSF | 12.084539 |

| 3SsnPorch | 11.372080 |

Box Cox Transformation of (highly) skewed features

skewness = skewness[abs(skewness) > 0.75]

print("There are {} skewed numerical features to Box Cox transform".format(skewness.shape[0]))

from scipy.special import boxcox1p

skewed_features = skewness.index

lam = 0.15

for feat in skewed_features:

all_data[feat] = boxcox1p(all_data[feat], lam)

There are 59 skewed numerical features to Box Cox transform

Dummy Variables for categorical features

all_data = pd.get_dummies(all_data)

print(all_data.shape)

(2917, 220)

ntrain = train.shape[0]

ntest = test.shape[0]

y_train= train.SalePrice.values

train = pd.DataFrame(all_data[:ntrain])

test = pd.DataFrame(all_data[ntrain:])

Regression Modeling

Importing Sklearn Packages for Modeling

from sklearn.linear_model import ElasticNet, Lasso, BayesianRidge, LassoLarsIC

from sklearn.ensemble import RandomForestRegressor, GradientBoostingRegressor

from sklearn.kernel_ridge import KernelRidge

from sklearn.pipeline import make_pipeline

from sklearn.preprocessing import RobustScaler

from sklearn.base import BaseEstimator, TransformerMixin, RegressorMixin, clone

from sklearn.model_selection import KFold, cross_val_score, train_test_split

from sklearn.metrics import mean_squared_error

import xgboost as xgb

import lightgbm as lgb

For Cross-validation purpose we can use cross_val_score function of Sklearn. However this function has not a shuffle attribut, we add then one line of code on Alexandru function, in order to shuffle the dataset prior to cross-validation

#Validation function

n_folds = 5

def rmsle_cv(model):

kf = KFold(n_folds, shuffle=True, random_state=42).get_n_splits(train.values)

rmse= np.sqrt(-cross_val_score(model, train.values, y_train, scoring="neg_mean_squared_error", cv = kf))

return(rmse)

Implementation of following Regression Models

1. Lasso Regression

2. Kernel Ridge Regression

3. Elastic Net Regression

4. Gradient Boosting Regression

5. XGBoost

6. Light GBM

Model Parameters Setting

#1

lasso = make_pipeline(RobustScaler(), Lasso(alpha =0.0005, random_state=1))

#2

KRR = KernelRidge(alpha=0.6, kernel='polynomial', degree=2, coef0=2.5)

#3

ENet = make_pipeline(RobustScaler(), ElasticNet(alpha=0.0005, l1_ratio=.9, random_state=3))

#4

GBoost = GradientBoostingRegressor(n_estimators=3000, learning_rate=0.05,

max_depth=4, max_features='sqrt',

min_samples_leaf=15, min_samples_split=10,

loss='huber', random_state =5)

#5

model_xgb = xgb.XGBRegressor(colsample_bytree=0.4603, gamma=0.0468,

learning_rate=0.05, max_depth=3,

min_child_weight=1.7817, n_estimators=2200,

reg_alpha=0.4640, reg_lambda=0.8571,

subsample=0.5213, silent=1,seed=7, nthread = -1)

#6

model_lgb = lgb.LGBMRegressor(objective='regression',num_leaves=5,

learning_rate=0.05, n_estimators=720,

max_bin = 55, bagging_fraction = 0.8,

bagging_freq = 5, feature_fraction = 0.2319,

feature_fraction_seed=9, bagging_seed=9,

min_data_in_leaf =6, min_sum_hessian_in_leaf = 11)

**Scores for Base Models

score = rmsle_cv(lasso)

print("\nLasso score: {:.4f} ({:.4f})\n".format(score.mean(), score.std()))

score = rmsle_cv(KRR)

print("Kernel Ridge score: {:.4f} ({:.4f})\n".format(score.mean(), score.std()))

score = rmsle_cv(ENet)

print("ElasticNet score: {:.4f} ({:.4f})\n".format(score.mean(), score.std()))

score = rmsle_cv(GBoost)

print("Gradient Boosting score: {:.4f} ({:.4f})\n".format(score.mean(), score.std()))

score = rmsle_cv(model_xgb)

print("Xgboost score: {:.4f} ({:.4f})\n".format(score.mean(), score.std()))

score = rmsle_cv(model_lgb)

print("LGBM score: {:.4f} ({:.4f})\n" .format(score.mean(), score.std()))

Lasso score: 0.1115 (0.0074)

Kernel Ridge score: 0.1153 (0.0075)

ElasticNet score: 0.1116 (0.0074)

Gradient Boosting score: 0.1167 (0.0084)

Xgboost score: 0.1165 (0.0058)

LGBM score: 0.1156 (0.0069)

Stacking Models

Approach: Averaging Base Models

#Average Based models class

class AveragingModels(BaseEstimator, RegressorMixin, TransformerMixin):

def __init__(self, models):

self.models = models

# we define clones of the original models to fit the data in

def fit(self, X, y):

self.models_ = [clone(x) for x in self.models]

# Train cloned base models

for model in self.models_:

model.fit(X, y)

return self

#Now we do the predictions for cloned models and average them

def predict(self, X):

predictions = np.column_stack([

model.predict(X) for model in self.models_

])

return np.mean(predictions, axis=1)

# Averaged base models score

averaged_models = AveragingModels(models = (ENet, GBoost, KRR, lasso))

score = rmsle_cv(averaged_models)

print(" Averaged base models score: {:.4f} ({:.4f})\n".format(score.mean(), score.std()))

Averaged base models score: 0.1087 (0.0077)

Defining rmsle evaluation function

def rmsle(y, y_pred):

return np.sqrt(mean_squared_error(y, y_pred))

Training and Prediction for Stacked Model

#StackedRegressor:

averaged_models.fit(train.values, y_train)

stacked_train_pred = averaged_models.predict(train.values)

stacked_pred = np.expm1(averaged_models.predict(test.values))

print(rmsle(y_train, stacked_train_pred))

0.0794023865241

XGBoost_Model and LightGBM(Gradient_Boosted_Model)

model_xgb.fit(train, y_train)

xgb_train_pred = model_xgb.predict(train)

xgb_pred = np.expm1(model_xgb.predict(test))

print(rmsle(y_train, xgb_train_pred))

model_lgb.fit(train, y_train)

lgb_train_pred = model_lgb.predict(train)

lgb_pred = np.expm1(model_lgb.predict(test.values))

print(rmsle(y_train, lgb_train_pred))

0.0782418795595

0.0724680051983

'''RMSE on the entire Train data when averaging'''

print('RMSLE score on train data:')

print(rmsle(y_train,stacked_train_pred*0.70 +

xgb_train_pred*0.15 + lgb_train_pred*0.15 ))

RMSLE score on train data:

0.0759625096638

Ensembled Final Predictions

ensemble = stacked_pred*0.70 + xgb_pred*0.15 + lgb_pred*0.15

sub = pd.DataFrame()

sub['Id'] = test_ID

sub['SalePrice'] = ensemble

sub.to_csv('submission.csv',index=False)